Feb 2024

CIEL FINANCE

News

Filter by

Mar 2024

CIEL GROUPCommuniqué on fake articles circulating on social media platforms

CIEL Limited would like to bring to your attention the emergence of false and misleading information circulating on several social media platforms concerning our Deputy Group Chief Executive, Mr. Guillaume Dalais.

Read more

Feb 2024

CIEL GROUPCIEL Group reports increased profits for the first half ended 31 December 2023

Commenting on the results, Jean-Pierre Dalais, Group Chief Executive of CIEL Limited said: “Our half-year results reflect our agility and capacity to seize market opportunities, notably through our strategic positioning in high-potential geographic areas such as Africa and India. We continue to focus on enhancing our portfolio and delivering steady value to our stakeholders. We will remain financially prudent; ensure we boost our operational excellence whilst being active on new investment opportunities.”

Read more

View the HORIZONS newsletter

View online

Jan 2024

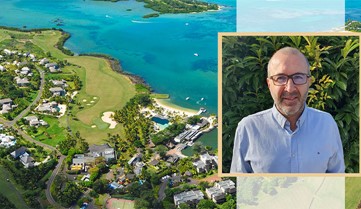

CIEL GROUPJean-Noël Wong Wan Khin appointed CEO of CIEL Properties

CIEL Properties is pleased to announce the appointment of Jean-Noël Wong Wan Khin as Chief Executive Officer, effective from January 1st, 2024.

Read more

Nov 2023

CIEL GROUPCIEL GROUP REPORTS INCREASED PROFITS FOR THE FIRST QUARTER ENDED 30 SEPTEMBER 2023

CIEL GROUP REPORTS INCREASED PROFITS FOR THE FIRST QUARTER ENDED 30 SEPTEMBER 2023

Read more

Sep 2023

CIEL GROUPCIEL Group posts MUR 4.3 bn Profit after Tax for the financial year ended 30 June 2023

Key highlights

The strategy execution across regions led to a strong financial performance

Read more

Jun 2023

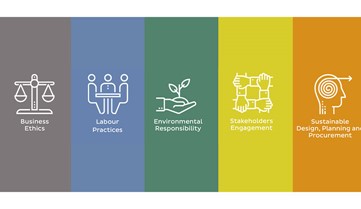

CIEL GROUPSeule une approche structurée en ESG peut rendre l’entreprise plus responsable

Longtemps montrées du doigt pour les conséquences sociales et environnementales de leurs activités, les entreprises multiplient les actions en matière de durabilité. Pour le Group Head of HR and Sustainability du Groupe CIEL, il faut plus qu’un engagement pour avoir un impact positif réel. La question de la durabilité doit être stratégique, c’est-à-dire que les initiatives doivent être mesurées mais surtout intégrées aux objectifs mêmes de performance.

Read more

Jun 2023

CIEL PROPERTIESCIEL Properties welcomes Jean-Noël Wong Wan Khin as Chief Operating Officer

CIEL Properties is pleased to announce the appointment of Jean-Noël Wong Wan Khin as Chief Operating Officer, effective from July 1st, 2023.

Read more

May 2023

CIEL GROUPCIEL Group delivers strong double-digit revenue growth across the portfolio leading to a solid net profit ofMUR 2.84 bn for the nine months to 31 March 2023

CIEL Group delivers strong double-digit revenue growth across the portfolio leading to a solid net profit of

MUR 2.84 bn for the nine months to 31 March 2023

May 2023

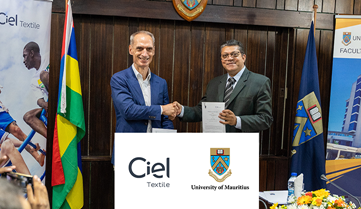

CIEL GROUPUn protocole d’accord signé entre CIEL Textile et l’UoM

CIEL Textile et l’Université de Maurice ont conclu un protocole d’accord (Memorandum of Understanding) pour une collaboration privilégiée en matière de recherche et de formation professionnelle. La cérémonie de signature s’est tenue ce mercredi 3 mai au campus de Réduit. Ce MoU permettra au groupe textile d’être accompagné par les équipes académiques dans ses réflexions sur les défis de l’industrie et aux étudiants d’accéder plus facilement au marché de l’emploi.

Read more

Mar 2023

CIEL GROUP"Il ne faut pas « fix the women », il faut surtout « fix the environment »"

CIEL a tenu, pour la première fois, un Women Forum ce 8 mars, pour mobiliser l’ensemble de ses cadres féminins autour d’une initiative visant à faciliter leur avancement au sein du groupe. Un travail qui a démarré il y a un peu plus d’an.

Read more

Jan 2023

CIEL GROUPCIEL – Diversification, résilience et agilité quels sont les points forts de vos secteurs d’activités ?

Groupe mauricien d’investissements diversifiés coté à la bourse de Maurice depuis 2014, le groupe Ciel est présent dans 6 secteurs d’activités. Après avoir débuté dans l’exploitation de la canne à sucre en 1912, le groupe s’est lancé dans le textile dans les années 70 et s’est diversifié par la suite dans les domaines de la finance, de la santé, de l’hôtellerie et de l’immobilier.

Read more

Jan 2023

CIEL PROPERTIESFerney accueille le premier projet d’un agrihood mauricien avec Montagne du Lion Farm Living

Agriculture durable, autonomie énergétique et maisons bioclimatiques au cœur du projet Montagne du Lion Farm Living de CIEL Properties dans la nature préservée du sud-est de Maurice

Read more

Dec 2022

CIEL GROUPAnnonce stratégique - Guillaume Dalais nommé Deputy Group Chief Executive du Groupe CIEL

Guillaume Dalais nommé Deputy Group Chief Executive du Groupe CIEL

Dans le cadre de son plan de succession, le Conseil d’Administration du Groupe CIEL a annoncé la

nomination de Guillaume Dalais en tant que Deputy Group Chief Executive à compter du 1er Janvier

2023.

Read more

Nov 2022

CIEL TEXTILEFloréal, 50 years of excellence

Floréal celebrated its 50th anniversary on Wednesday, 26 October, in its former premises in Mangalkhan, now refurbished and converted into a modern and elegant business centre known as Nouvelle Usine. The setting of this building has kept its original features. It embodies the leading Mauritian textile group's devotion, values, and determination to place sustainability at the heart of its development. "With Nouvelle Usine, we are entering a new era of shared and sustainable growth", summarised Jean-Pierre Dalais, Chairman of the Board of CIEL Textile.

Read more

Nov 2022

CIEL TEXTILECIEL Textile célèbre l’excellence de ses talents

Le Chairman's Manufacturing Excellence Awards (CMEA) de CIEL Textile, un événement bisannuel récompensant les talents et les performances exceptionnels des 19 unités du groupe, a pris une nouvelle dimension cette année.

Contrairement aux précédentes éditions, la cérémonie réunissait les segments Apparel (confection) et Capital-Intensive (tissage et filature). Les Chairman’s Manufacturing Excellence Awards, ont été décernés à Aquarelle Inde - RCC et FSM Carding and Spinning, représentant respectivement chacun de ces segments. Ce prix vient récompenser l’unité ayant démontré les meilleurs niveaux d’excellence toutes catégories confondues.

Read more

Oct 2022

CIEL HOTELS & RESORTSLuxury Mauritian Hotel Group, Sun Resorts enters a new era as “Sunlife”

Mauritian hotel brand formerly known as Sun Resorts unveils its exciting rebrand and rebirth, Sunlife.

Mauritian hotel group, Sun Resorts has announced an exciting new rebrand, unveiling the new Sunlife, not just a new name but a reimagined philosophy and culture across all areas of the guest experience, building on the brand’s 45 plus years of history and heritage. The rebrand includes the newly launched ‘Come Alive Collection’ – a range of unique in resort experiences for guests to enjoy including Energy Gym, Sega Zoomba and Putting on the Ritz to name just a few.

Read more

Sep 2022

CIEL GROUPCIEL Limited posts robust financial results for the year ended 30 June 2022

For the year ended 30 June 2022, CIEL Limited reported a robust set of financial results, notwithstanding the backdrop of macroeconomic disruptions and a weakening global economy.

Read more

Sep 2022

CIEL PROPERTIESCIEL Properties lance Evolis

Le Groupe CIEL, à travers son pôle immobilier lance Evolis Properties. La mission de cette nouvelle entité de CIEL Properties est de venir consolider certains actifs du Groupe en fin de vie et les transformer en des lieux dynamiques, prêts à accueillir une nouvelle génération d’acteurs économiques et sociaux.

Read more

Aug 2022

CIEL TEXTILEMaking a difference in sustainable knitwear

As Floreal celebrates its 50th anniversary this year, Amit Khullar, Chief Executive Officer of Floreal Group, shares his drive and passion for making a difference when it comes to sustainable knitwear by taking steps to reduce waste, cut carbon emissions and improve the well-being of its people.

Read more

Jul 2022

CIEL FINANCEFITCH RATES BANK ONE ‘BB-‘ WITH A STABLE OUTLOOK

Bank One is pleased to announce that it has received a Long-Term Issuer Default Rating (IDR) of ‘BB- ‘with a Stable Outlook from Fitch Ratings for its first rating exercise.

On 27th June - The rating was made public by Fitch Ratings (London) and Bank One is now ranked among the top 15 banks in Sub Saharan Africa.

“I am delighted that after working closely with Fitch Ratings over the past months, we have been awarded such a positive rating. The new rating confirms our reputation as a trusted partner for our customers and we look forward to growing our business in Mauritius and the rest of Sub Saharan Africa.” said Mark Watkinson, CEO of Bank One.

Read more

Jun 2022

CIEL GROUPMAURITIUS-LISTED CIEL LTD MARKS ITS 110TH ANNIVERSARY WITH A REVENUE INCREASE OF OVER 50%.

Mauritius-listed African investment company CIEL Limited (CIEL.N0000) delivered its best year-to-date results since the COVID-19 pandemic, surpassing its previous performance just as it celebrates its 110th anniversary.

In the nine months to 31 March 2022, CIEL’s revenue grew 51% to USD 475 million, with an EBITDA margin increasing to 16.8% from 12.2% in the prior-year period.

Read more

May 2022

CIEL GROUPCIEL Limited delivered a solid performance across its diversified portfolio in the nine months ended 31 March 2022.

In the nine months to 31 March 2022, CIEL achieved 51% revenue growth while delivering robust EBITDA margins and improved Free Cash Flows. Third quarter earnings confirm a solid year-to-date trajectory, notwithstanding the ongoing logistical and pandemic-related challenges in certain sectors as well as the indirect impacts from the Ukraine/Russia conflict on cost inflation.

Read more

Mar 2022

CIEL HEALTHCAREC-Lab: Unlocking the benefits of genomics

As we look back, the pandemic has paved the way for a new era in medical diagnostics in Mauritius, where genomic data will increasingly drive the future of health care. As our ability to read genes becomes faster and cheaper, genetic sequencing is leading the way for everything from enhanced disease surveillance to personalised care referred to as precision medicine.

Read more

Feb 2022

CIEL GROUPCIEL célèbre ses équipes et l’innovation

Se réinventer, expérimenter, inspirer, saisir de nouvelles opportunités ; l’innovation est au cœur de la stratégie du Groupe.

CIEL encourage cet esprit « intrapreneurial » depuis toujours parmi ses collaborateurs. En lançant il y a trois ans le CIEL Innovation Awards, le Groupe est venu catalyser une culture d’innovation, stimuler les idées et faire émerger des projets impactants au sein du Groupe.

Read more

Feb 2022

CIEL GROUPCIEL announces strong performance from its diversified portfolio for the half-year ended 31 December 2021

In the first six months of the 2021-2022 financial year, CIEL reported strong growth and improved profitability. This rebound highlights CIEL’s competitiveness in fast-growing international markets and its pertinent strategic positioning. The agility of the group and its capacity to rebound is reflected in the 5.8 percentage point increase in the EBITDA margin to 17.1%. The continued upward trend in profit after tax further demonstrates the effectiveness of its business models which combined with strong cost management discipline and conclusive restructuring has helped the group successfully navigate the last two years of the pandemic.

Read more

Feb 2022

CIEL PROPERTIESCIEL Properties s’attelle à la régénération de son parc industriel : l’usine de Floréal Knitwear transformée en une destination urbaine nouvelle génération.

Les équipes de CIEL Properties travaillent depuis plusieurs mois maintenant à l’optimisation des actifs industriels du Groupe et lancent cette semaine la commercialisation d’un projet unique en son genre. C’est l’ancienne usine de Floréal Knitwear, situé au cœur de Mangalkhan, qui fera l’objet d’un ambitieux projet de régénération. Ce projet de réhabilitation vise à transformer l’ancienne usine en une destination urbaine qui promeut l’entreprenariat au sein d’un univers industriel complètement repensé

Read more

Dec 2021

CIEL GROUPCIEL ‘Go Beyond Gender’ programme rolled-out across clusters

With the vision to promote the development of women at work and an ambitious target of 35% of women at management level by 2030, CIEL Go Beyond gender programme is being rolled out across the Group. Check out the pictures of the first CIEL Textile ‘Go Beyond Gender’ forum where top leaders and participants across Mauritius, India, Madagascar and Bangladesh were gathered. Sub-working groups will now be tackling specific topics with the view to implement action plan across the organisation.

Read more

Dec 2021

CIEL PROPERTIESIl faut tendre vers des projets bas-carbone

CIEL a récemment mis l’accent sur l’immobilier avec la création du pôle immobilier que vous dirigez, quels sont les objectifs du groupe dans ce secteur ?

Le Groupe CIEL, au travers de ses différents secteurs d’activités, dispose d’actifs immobiliers importants et la mise en place du pôle CIEL Properties nous permet de mobiliser une équipe dédiée afin d’optimiser leur gestion. C’est aussi pour nous une volonté de planifier de manière stratégique notre développement en accélérant la transition et l’efficience énergétique de nos bâtiments, en identifiant des synergies potentielles et en créant des concepts novateurs qui trouvent écho sur le marché.

Read more

Dec 2021

CIEL FINANCEA Story about Data - CIEL Finance Data Services

Data! Data! Data! From line managers to executives – everyone is asking: What are we doing about our data journey? Can we trust this data? What insights are you pulling from the data? And of course, can we make a dashboard with this data…?

Read more

Dec 2021

CIEL PROPERTIESKatapult launches impact accelerator in Mauritius

During the last years, Katapult has developed several close partnerships in Mauritius and the region. Katapult is now launching the Katapult Mauritius Accelerator at Ferney Agri-hub in partnership with CIEL, IBL Group, Currimjee Group and MCB Group.

Read more

Oct 2021

CIEL HEALTHCAREC-Care driving innovation

Congratulations to all the participants of the C-Care Innovation Awards which was held earlier this week. Aimed at stimulating innovative ideas and impactful projects, the C-Care Innovation Awards saw the participation of colleagues from all business units of the Group. During the event, innovation was not solely represented by new technologies or methods, but also by the process of uncovering new and different ways to do things and #GoBeyond!

Read more

Oct 2021

CIEL GROUPThrowback to the CIEL Innovation Awards Jury convention days!

Teams from the different clusters of CIEL showcased their innovative projects and ideas to our jury under one of the three categories: DigitalTransformation, ReinventingCustomerExperience and SustainableSolutions. This 2nd edition and the high quality of projects and ideas presented is a testimony of CIEL’s commitment to Go Beyond and how we are embracing change through innovation across the Group.

Read more

Oct 2021

CIEL TEXTILECIEL Textile at the 2021 UN Climate Change conference COP26

Another major step on CIEL Textile’s mission to improve fashion everyday: we will be present next month at the 2021 UN Climate Change conference COP26 - a 3-day Summit event organised by the United Nations - to share CIEL Textile’s actions on how to holistically drive sustainability! As part of this recognition, Bertrand Thevenau and Quentin Thorel will be heading to Edinburg on the 8th to 10th of November to share CIEL Textile’s work with the UN delegation and other climate leaders from around the globe. Kudos to the team and stay tuned!

Read more

Oct 2021

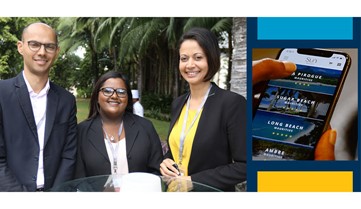

CIEL FINANCELaunch of Pop by Bank One

The first and only universal digital payment solution in Mauritius… This is how we could describe Pop in a few words! With the desire to make financial services accessible to everyone in Mauritius, no matter where they bank and offering a great user experience to their customers on the platform, Bank One positions itself as a key player in the digital financial services sector in the island. Congratulations to the whole team working on this app!

Read more

Sep 2021

CIEL GROUPCIEL Limited reports financial results for the full year ended 30 June 2021

The decisive actions taken by CIEL in response to the global pandemic in early 2020 have enabled the Group to emerge stronger and leaner out of the crisis. Group revenue of MUR 17.9 bn and EBITDA of MUR 2.7 bn resulted in an EBITDA margin of 15.1% for the financial year ended 30 June 2021 (2020: 14.6%), despite revenue that has not yet fully recovered to pre-pandemic levels. CIEL’s profit after tax for the year stood at MUR 446M compared to MUR 2,178M losses in the prior period.

Read more

Aug 2021

CIEL TEXTILEOngoing reforestation programme by CIEL Textile Madagascar

With the objective of restoring forest landscape to safeguard biodiversity, more than 400 employees from Aquarelle, Laguna, Tropic and Floreal Madagascar gathered with local associations to plant trees in different areas of Madagascar. To date, more than 100,000 trees have been planted. Congrats to our CIEL Textile teams in contributing to a healthier planet!

Read more

Aug 2021

CIEL FINANCEBank One announces new additions to its senior leadership team

Bank One is pleased to announce new appointments to its Management Executive Committee to support its growth strategy and long-term strategic focus in Sub-Saharan Africa. Bhavya Shah joins as Head of Personal Financial Services and Kenny Morton as Head of Regulatory Affairs.

Read more

Aug 2021

CIEL HOTELS & RESORTSSun launches a new digital campaign #MyfirstSUNkissed

In line with the reopening of borders in Mauritius, Sun launches a campaign showcasing essentially the core emotions travellers can/could feel when visiting Mauritius after months of confinement. Travellers are encouraged to share their pictures with their digital community to spread some happy vibes after the rough times the tourism industry has been through. Check out the hashtag on the different social media platforms to discover beautiful pictures of Mauritius island.

Read more

Aug 2021

CIEL FINANCEBanking on digital channels to get ahead in the new normal

In Mauritius, as across the world, the move to digital payments has been noticeable following the COVID-19 outbreak. While mobile money wallets, online banking platforms and contactless payments had been gaining traction even before the pandemic broke, the impact of the COVID-19 crisis on accelerating the adoption of digital payments in Mauritius cannot be underestimated.

Read more

Aug 2021

CIEL GROUP4th edition of the CIEL Women Network

More than 20 women working across various business clusters of the Group gathered to share their work and life experiences around topics related to women empowerment and leadership, in the presence of Christine Sauzier, Sheila Ujoodha and Delphine Ahnee. One more step towards increasing gender equality and enabling economic growth and human development!

Read more

Aug 2021

CIEL HOTELS & RESORTSProtecting our coastline

Sun employees have participated in a clean-up, both on the East and West coast of the island, in collaboration with surrounding resorts and local authorities. Kudos to all Sun employees who generously donated of their time and energy to help protect the coastline of Mauritius!

Read more

Aug 2021

CIEL TEXTILECIEL Textile: new partnership for more transparency

CIEL Textile partners with leading B2B platform, Serai, to enhance its supply chain traceability, thus helping the Group gain deeper insights and important metrics. This partnership will allow the Group to drive operational efficiencies and greater supply chain transparency, a key step on its sustainability journey.

Read more

Jun 2021

CIEL PROPERTIESReplacing plastics with organic cotton socks

What if we could eliminate plastic potting bags? This is the challenge CFL team, in partnership with La Vallée de Ferney Conservation Trust, successfully worked on. 2,000 biodegradable socks were produced enabling a smooth transplantation and completely removing plastics from the process. Well done to CFL and Ferney.

Read more

May 2021

CIEL TEXTILECIEL TEXTILE publishes its first “Sustainability Report” while engaging with its partners and customers around sustainable development.

100% digital, CIEL Textile is pleased to present its first sustainability report developed in accordance with GRI standards. The report entitled “Winning Well” provides a transparent overview of the current state of the Group’s sustainability achievements and progress. It demonstrates CIEL Textile’s objective to be a “Sustainable Global Fashion Partner” for leading international fashion brands.

Read more

May 2021

CIEL HOTELS & RESORTSSun Resorts publishes its Sustainability Report

Committed to applying daily sustainability practices in the way it does hospitality, Sun Resorts shared recently its Sustainability Report showcasing its efforts, and achievements towards strong ESG practices.

Read more

May 2021

CIEL AGROAlteo affiche des résultats positifs pour les neuf premiers mois de l’année financière

Hausse des profits pour le groupe Alteo. C’est ce qui ressort du rapport financier du groupe pour les neuf premiers mois de l’année financière 2020-2021, publié ce 13 mai 2021. En effet, les profits nets comptabilisés du groupe opérant dans les secteurs du sucre, de l’énergie et du développement foncier, passent de Rs 802 millions en mars 2020 à Rs 1 459 millions en mars 2021. Cette augmentation s’explique principalement par une bonne performance des activités sucrières du groupe en Tanzanie. Le pôle immobilier du groupe affiche, lui, de moins bons résultats pour la période écoulée dû à l’impact de la pandémie.

Read more

May 2021

CIEL FINANCEBNI MADAGASCAR soutient 133 jeunes entrepreneurs

Dans le cadre du projet ‘Titre Vert’ lancé par le Président de la République malgache Andry Rajoelina, BNI MADAGASCAR apporte un soutien financier à 133 jeunes entrepreneurs dans le domaine de l’agriculture. C’est à travers le programme FIHARIANA de la 2e marque de la

BNI MADAGASCAR, KRED que la banque aide les entrepreneurs agricoles malgaches dans le développement de leurs activités.

May 2021

CIEL GROUPCIEL’S DIVERSIFIED PORTFOLIO AND GEOGRAPHIC FOOTPRINT CONTINUE TO MITIGATE THE IMPACT OF THE GLOBAL PANDEMIC ON ITS FINANCIAL PERFORMANCE

A full year now has elapsed since the start of the global COVID-19 pandemic which caused recurring periods of lockdowns as well as travel and operating restrictions in Mauritius and abroad. In this year like no other, CIEL Group’s results continue to show resilience. The particularly good performance of the Textile, Healthcare and Agro & Property clusters reflect the benefits of the Group’s diversified investment portfolio and geographical footprint.

Read more

May 2021

CIEL HEALTHCAREMask-up! C-Care nurses remind us of the importance of respecting COVID protocols

On 12 May, C-Care celebrated International Nurses Day to shed light on the commitment and passion of its nursing staff. It was also an opportunity to reemphasise the crucial role of medical staff during this pandemic and the importance of respecting COVID protocols to keep each other safe

Read more

May 2021

CIEL GROUPOur leaders in the last issue of MEDEF PARIS magazine

Jean-Pierre Dalais, and Patrick Lee, CEO of MITCO Group answered few questions on the Group’s strong relationship with France, the impacts and economic recovery post COVID-19, and high-end services provided in the Global Business and Corporate Services sector, respectively.

Read more

May 2021

CIEL GROUPCIEL’s first Sustainability Dashboard is out!

Aiming to track our progress against our objectives - which have been announced in CIEL’s 2020-2030 Sustainability Strategy, the 2019-2020 Sustainability dashboard will allow our teams to accelerate the Group’s sustainability efforts and #GoBeyond waste pollution, gender equalities, climate change, biodiversity loss and social inequalities.

Read more

May 2021

CIEL TEXTILECIEL Textile on CNN Africa

Check out this video by CNN Africa showcasing how CIEL Textile is reinventing itself by betting on technology and sustainability to be the best global fashion partner.

Read more

May 2021

CIEL GROUPJean-Pierre Dalais: « Un plan de relance agressif est nécessaire »

Dans une interview accordée au journal Le Défi Plus, Jean-Pierre Dalais partage son opinion sur les conditions de la relance et le développement économique futur.

Read more

Mar 2021

CIEL FINANCECitigroup décerne le Straight-Through Processing Excellence Award à Bank One

Bank One a le plaisir d’annoncer que Citigroup lui a récemment remis le Straight-Through Processing (STP) Excellence Award en reconnaissance de sa performance exceptionnelle dans le traitement des paiements internationaux, en particulier en dollars américain et en euros.

Read more

Mar 2021

CIEL FINANCECorporate Banking: focusing on opportunities and innovation in challenging times

Fareed Soobadar, Head of Corporate Banking at Bank One, explains that it is time for Mauritius to seize business opportunities in Africa, against a challenging international backdrop, and that innovation and digitalisation will be the watchwords for the future to meet customer needs and expectations in the corporate banking arena.

Read more

Mar 2021

CIEL GROUPHappy International Women's Day

For a world where our voices may always be heard, respected and valued...

Happy International Women’s Day!

To mark this day, we wanted to highlight seven women of the Group sharing their career path and views of this special day:

Mar 2021

CIEL FINANCELakshman Bheenick takes the helm of CIEL Finance

The Board of Directors of CIEL Finance is pleased to announce the appointment of Lakshman Bheenick as CEO of CIEL Finance, as of 1 March, 2021. He succeeds Marc-Emmanuel Vives who expressed his wish to leave the company for personal and family reasons.

Read more

Feb 2021

CIEL GROUPCIEL delivers strong operational performance across all its clusters except for its tourism activities which continue to weigh on the Group’s results

CIEL published today its results for the first semester ended 31st of December 2020. The Group is demonstrating tangible recovery from the unprecedented disruption caused by the coronavirus pandemic outbreak nearly a year ago. While the Hotels & Resorts cluster will continue to weigh on the Group’s profits until the complete restart of the industry, CIEL’s positioning in international markets and strategic segments shows strong operational results, particularly from its Healthcare and Agro & Property clusters but also its Finance cluster.

Read more

Jan 2021

CIEL AGROAlteo célèbre ses talents avec le premier RISE Awards

Reconnaitre les employés du groupe qui représentent le mieux les valeurs d’Alteo. Tel est l’objectif du RISE Award 2020, lancé par André Bonieux, CEO d’Alteo. Ainsi, 34 employés du groupe, Staff et Non-staff, ont ainsi été nominés par leurs chefs d’équipes respectifs et 8 d’entre eux, sélectionnés par un jury composé d’André Bonieux, Sebastien Lavoipierre, COO des activités industrielles, Arnaud d’Unienville, COO des activités agricoles d’Alteo et Sophie Strauss, HR Executive d’Alteo, ont été récompensés. 33 des 34 nominés étaient réunis à l’occasion d’une cérémonie de remise de prix, (Patrick Yene Teck a lui reçu le prix pour sa collegue Chantal Rivalland absente), qui s’est tenue dans le Club House d’Alteo Union Flacq, le vendredi 15 janvier 2021.

Read more

Jan 2021

CIEL FINANCECIEL Finance announces the appointment of Patrick Lee as CEO of MITCO

CIEL Finance announces the appointment of Patrick Lee as Chief Executive Officer of MITCO Group Ltd (“MITCO”), a Trust and Corporate Services Group operating in the Global Business and Corporate Services.

Read more

Dec 2020

CIEL FINANCEGlobal Retail Banking Innovation Awards 2020: Bank One voted “Credit Card of the Year”

Bank One is pleased to announce that it has been awarded the title of “Credit Card of the Year” for its maiden participation to the Global Retail Banking Innovation Awards 2020 organised by the Digital Banker. The Global Retail Banking Innovation Awards recognise and celebrate the world’s preeminent retail banking institutions and the contribution of their teams to the industry.

Read more

Dec 2020

CIEL FINANCEBank One wins three distinct awards at the Global Banking & Finance Awards

We are pleased to announce that the Global Banking & Finance Review has awarded Bank One for Best SME Bank Mauritius 2020, Best Corporate Governance Bank Mauritius 2020 and Best Custodian Bank Mauritius 2020. Launched in 2011, the Global Banking & Finance Awards honour institutions bringing inspirational changes within the global financial community.

Read more

Dec 2020

CIEL FINANCEBank One teams up with the Global Rainbow Foundation to make banking easier for the hearing-impaired

On December 3rd, International Day of Persons with Disabilities, the Global Rainbow Foundation launched a leaflet in collaboration with Bank One. Written in English, French and Creole, this leaflet will help improve communication between the staff of Bank One and clients from the hearing impaired community.

Read more

Nov 2020

CIEL GROUPCIEL Limited reports financial results for the Full Year 2019-2020 and First Quarter ended 30 September 2020

The COVID-19 pandemic had an unprecedented impact on the global economy and CIEL Group’s results for the year ended 30 June 2020 were affected – particularly the second half of the financial year.

While CIEL Group performed well in the first semester, the Hotels & Resorts cluster noted a drop in occupancy as from January 2020 onwards due to lockdown in China - an important clientele for their up-market resorts. The Chinese lockdown also disrupted certain supply chains in the Textile cluster.

Read more

Nov 2020

CIEL PROPERTIESOuverture du Ferney Nature Lodge

CIEL innove et mise résolument sur l’éco-tourisme avec l’ouverture du Ferney Nature Lodge

Niché au cœur de la Vallée de Ferney dans un domaine de 2 300 hectares, CIEL Properties lance ce mois-ci le Ferney Nature Lodge. Unique à Maurice, le Ferney Nature Lodge offre tout le confort d’un établissement haut de gamme au cœur de la nature et à l’écart de toute civilisation.

Read more

Sep 2020

CIEL PROPERTIESCIEL Launches an Agri-Hub in Ferney

In line with the Group's recently unveiled sustainability development strategy and in order to increase the country's food security, CIEL is launching an Agri-Hub within its Ferney estate in the south-east of the island. An area of 20 hectares has been identified to accommodate agri-entrepreneurs who wish to develop their production according to sustainable practices. Larger areas are also available for large agricultural operators.

Read more

Aug 2020

CIEL GROUPMessage from Jean-Pierre Dalais - MV Wakashio: Thank you for your engagement

THANK YOU all for your help and amazing energy over the past few days to protect our coastline from the oil spill of the MV Wakashio.

CIEL’s mobilisation

There has been an incredible contribution from all the Group’s clusters to participate in this national effort. Colleagues and volunteers from all over the country joined us at Falaise Rouge and Anahita during the weekend to manufacture the floating booms and help contain the oil reaching the shores.

Aug 2020

CIEL GROUPCIEL commits to sustainability targets

Ebene, Tuesday 04th of August 2020 – At a time when the COVID-19 crisis is challenging traditional

habits, more than ever, CIEL is committed to pursuing a holistic sustainable development strategy.

Jul 2020

CIEL TEXTILEEric Dorchies officially succeeds Harold Mayer as CEO of CIEL Textile

As previously announced by the CIEL Textile’s Board of Directors in 2019, Eric Dorchies officially becomes this Wednesday, 1st of July, the new Chief Executive Officer of CIEL Textile. He succeeds Harold Mayer...

Read more

Jul 2020

CIEL PROPERTIESGuillaume Dalais appointed CEO of CIEL Properties

Guillaume Dalais has been appointed as the Chief Executive Officer of CIEL Properties, effective as from this Wednesday, 1st of July 2020. The nomination of Guillaume Dalais...

Read more

Jun 2020

CIEL FINANCEBank One raises MUR 600 million for its first issuance on the Mauritian Capital Market

(Port Louis, Mauritius) – 29 June 2020 – We are pleased to announce that Bank One has raised MUR 600 million in Subordinated Tier 2 Capital for its maiden issuance on the Mauritian Debt Capital Market. The transaction was successfully concluded with PLEION Corporate Finance Ltd acting as the Transaction Adviser.

Read more

Jun 2020

CIEL HOTELS & RESORTSDéveloppement durable : La Pirogue obtient la certification Travelife Gold

La Pirogue, hôtel réputée de la côte ouest, a reçu la prestigieuse certification Travelife, dédiée aux hôtels et logements. Certification de développement durable par excellence, Travelife évalue la performance de l’hôtel et fournit une norme de certification innovante pour évaluer, prouver et communiquer les réalisations de développement durable. L’audit s’est déroulé pendant plusieurs jours en fin d’année 2019. Une équipe dédiée à cette cause particulière s’est mise au travail avec le support du General Manager et les employés de l’hôtel.

Read more

Jun 2020

CIEL FINANCEBank One supports women entrepreneurs

Launched in 2019 by Bank One's CSR unit and Lakaz Lespwar Caritas Solitude, the empowerment programme entitled “Fam deboute lor to lipied” rewarded its first beneficiaries earlier this week. During an award ceremony held at Caritas Solitude, Bank One handed out cheques to five women entrepreneurs to enable them to kick-off their activities. In September 2019, the five women started a training provided by Caritas Solitude, its partner Junior Achievement Mascareignes (JAM) after a panel composed of the CSR committee of Bank One and the Lakaz Lespwar Caritas Solitude team selected their projects.

Read more

Jun 2020

CIEL GROUPJean-Pierre Dalais, Group Chief Executive de CIEL : "Il est important de rallumer ou permettre l'accélération des moteurs économiques qui ont été stoppés ces 3 derniers mois..."

Interview de Jean-Pierre Dalais, Group Chief Executive de CIEL dans le journal Le Défi - mercredi 24 juin 2020 Comment envisagez-vous la relance économique ? Il est important de rallumer ou permettre l’accélération des moteurs économiques qui ont été stoppés ces trois derniers mois et notamment les secteurs générateurs de devises étrangères : les loisirs, l’habillement, le Business Process Outsourcing, les services financiers (qui ont continué à fonctionner). Il faut insuffler tout le dynamisme nécessaire à ces secteurs. C’est fondamental.

Read more

Jun 2020

CIEL HOTELS & RESORTSSun Resorts lance le protocole sanitaire SunCare

Suite à l’annonce en mai dernier de la collaboration avec SGS pour le label d'évaluation et de la désinfection pour l'industrie hôtelière, Sun Resorts lance aujourd’hui son protocole sanitaire SunCare, qui comprend son propre label SunCare - «Clean Resorts».

Read more

May 2020

CIEL GROUPCIEL Limited reports financial results for the period ended 31 march 2020

The Covid crisis partially affected the Group nine months result especially in the hotel, textile, and healthcare clusters while the lower performance of Bank One has had a negative effect on the finance cluster. Group revenue for...

Read more

May 2020

CIEL AGROCovid-19: Alteo met en place un fonds de solidarité financé par le groupe et ses employés

Alteo accentue ses initiatives solidaires pendant cette crise du Covid-19. En effet, le groupe a créé un fonds de solidarité interne, qui sera financé grâce à une contribution salariale de l’équipe de direction de l’entreprise pour les mois de mai et de juin 2020.

Read more

Apr 2020

CIEL GROUPCOVID-19: Message from our Group Chief Executive

As the global situation regarding COVID-19 continues to evolve, our Group Chief Executive, Jean-Pierre Dalais, shares his thoughts on the crisis, its impact and how we are addressing it.

Read more

Apr 2020

CIEL PROPERTIESCOVID-19: Alteo Assure Un Nettoyage En Profondeur De Ses Sites

Dans le sillage de la pandémie du Covid-19 et du couvre-feu sanitaire imposé à Maurice depuis mars, Alteo mets les bouchées doubles afin d’assurer la santé et la sécurité de ses équipes.

Read more

Apr 2020

CIEL GROUPCOVID-19 : Mobilisation of CIEL Teams to support national efforts

On this 21st day of confinement in Mauritius, we wanted to share the amazing initiatives taken across the Group to help in this unprecedented crisis situation.

Read more

Mar 2020

CIEL GROUPCOVID-19: Message from Jean-Pierre Dalais, Group Chief Executive

Dear colleagues, As you know, the Mauritian authorities have implemented a total confinement as of today for the next two weeks. Essential services and some manufacturing activities will be allowed to remain open to ensure that life continues despite this crisis that affects us all. I would thus like to salute our colleagues in healthcare, banks and hotels who are mobilised on the front line, in a particularly difficult context, to continue serving our customers with the same passion and determination. My thoughts also go to our teams at CIEL Textile who have been asked to close all operations temporarily today.

Read more

Mar 2020

CIEL HOTELS & RESORTSKanuhura Maldives achieves Forbes Travel Guide 5 Star Award

Sun Resorts is proud to announce that Kanuhura Maldives receives the “Forbes Travel Guide 5 Star Award”. This award is the highest recognition of our dedication to service excellence, commitment and a true sense of hospitality. Kanuhura Maldives is acclaimed for its “bohemian feel with whitewashed villas adorned with funky art and Iru bar’s beaded swings and beach teepee”. The Maldives made a splashy debut on the list, picking up six of the highest awards. Kanuhura Maldives is listed alongside Four Seasons Resort Maldives at Kuda Huraa and St. Regis Maldives Vommuli Resort in the Maldives.

Read more

Mar 2020

CIEL HOTELS & RESORTSSun Resorts' Kanuhura Maldives awarded "Global Best Employer Brand Award"

Kanuhura Maldives has been awarded the “Global Best Employer Brand Award” by Employer Branding Institute. This now renowned institution features the Top Organisations who are exemplary and used marketing communications effectively for Human Resources Development & Hospitality Industries.

Read more

Mar 2020

CIEL PROPERTIESAlteo : Rachel Lamalétie et Varoon Seewooram remporte le 1er prix de l’Innovation Challenge

Bagatelle, le 28 février 2020. Les grands gagnants de l’édition inaugurale de l’Alteo Innovative Minds, le concours d’innovation interne du groupe, sont enfin connus ! Rachel Lamalétie et Varoon Seewooram, du département des ventes d’Anahita Estates, ont remporté le grand prix de cette compétition avec leur projet Alteo We Care, axé sur le bien-être des employés du groupe, empochant ainsi la somme de Rs 50 000. 8 autres équipes ont aussi été récompensées pour les projets soumis à ce concours. Les équipes participantes ainsi que bon nombre d’employés d’Alteo étaient présents pour la cérémonie de remise de prix qui s’est tenue au Cinéma Star, à Bagatelle, le jeudi 27 février.

Read more

Feb 2020

CIEL FINANCEMeet Gabriel Froid, the multi-talented Assistant Relationship Officer at MITCO GROUP

Our selected personality of the month is Mr. Gabriel Froid who intelligently and passionately juggles the corporate world and the artistic field, more specifically the Fashion Industry.

Read more

Feb 2020

CIEL TEXTILECIEL Textile's sustainability milestones in 2019

These numerous sustainable milestones - requiring a lot of hard work and strategic foresight - were made possible thanks to the strong commitment of teams across CIEL Textile’s 20 business units.

Read more

Jan 2020

CIEL AGROCampagne sucrière 2019 : record de Maurice pour une récolteuse d’Alteo

100 000 tonnes de cannes récoltées en une saison ! C’est la performance remarquable réalisée lors de la coupe 2019 par une des récolteuses d’Alteo. Cela, alors qu’une machine de ce type récolte entre 50 000 et 70 000 tonnes chaque saison. Ce tonnage exceptionnel est le fruit du travail acharné d’une équipe d’opérateurs, de surveillants, de mécaniciens et d’encadrants et ils étaient tous réunis pour marquer l’événement à la fin de cette fin de campagne sucrière.

Read more

Jan 2020

CIEL FINANCERencontre avec Priscilla Mutty, responsable des ressources humaines chez Bank One

Elle semble être taillée pour cet univers où le facteur humain prédomine. Priscilla Mutty, est la responsable des ressources humaines chez Bank One, un poste qu’elle assure avec passion et détermination. Rencontre.

Read more

Jan 2020

CIEL TEXTILELaguna Clothing's non-iron journey

After years of perseverance, Laguna Clothing has mastered the application of their unique non-iron technology to fine fabrics to meet the needs of a constantly-evolving niche market.

Read more

Dec 2019

CIEL TEXTILEAquarelle Group: 3D Virtual Design & Sampling

The fashion industry is known to be a fast-evolving one and this gives rise to a constant need for evolution and innovation. The reduction of production lead time and costs are key problems in such an industry. The Aquarelle Group, proud winner of the Best Quality Circle Award at the CIEL Innovation Awards 2019, has thus proposed a time- and cost-saving solution: 3D Virtual Design and Sampling. This method uses cutting-edge 3D technology from the designing of a garment all the way down to the retailing process.

Read more

Dec 2019

CIEL HOTELS & RESORTSSun Resorts: Enhancing the guest journey through digitalisation

To adapt to the significant changes in the hotel industry, Sun Limited ("SUN") has launched an automation and digital transformation strategy with the aim of enhancing customer experience as well as increasing direct bookings.

Read more

Nov 2019

CIEL TEXTILERencontre avec Charline Le Corre, la Front End & Sales Manager de Tropic Knits

Charline Lacorre, une jeune femme dynamique et une énergie positive à revendre ! Elle enchaîne des sessions de travail, véritables moments d’échanges avec ses collaborateurs, dans une ambiance conviviale. La Front-End & Sales Manager de Tropic Knits a su, à force de détermination et de son écoute active, imposer son savoir-faire et son sens des responsabilités auprès de ses équipes. Portrait.

Read more

Nov 2019

CIEL FINANCEPritee Ombika-Aukhojee: L’humain au cœur de la finance

Du haut de ses 17 ans de carrière dans l’univers financier, Pritee Ombika-Aukhojee n’en démord pas. Jongler avec les chiffres et les stratégies, elle adore ! Head of Direct Sales à la Bank One, elle carbure aux défis mais n’en oublie pas pour autant l’aspect humain du métier.

Read more

Nov 2019

CIEL FINANCEBank One soutient la sélection nationale de football de moins de 20 ans

La sélection nationale de moins de 20 ans bénéficie du soutien de Bank One dans le cadre de sa participation à la COSAFA U20, prévue du 4 au 14 décembre, et à la National Division 1. Un partenariat d’une durée d’un an a été scellé entre Bank One et la Mauritius Football Association (MFA), lors d’une cérémonie le 18 novembre au siège de Bank One à Port-Louis.

Read more

Nov 2019

CIEL HOTELS & RESORTSStéphane Turin appointed new General Manager of Anahita Golf Club

Stéphane Turin has been appointed new General Manager of Anahita Golf Club and will officially assume his new duties mid-January 2020. Stéphane’s mission will be to ensure the progress and sustained growth of the Club. He will report to Patrice Legris CEO of Alteo’s property cluster as well as to the Board of Anahita Golf Limited, chaired by André Bonieux, CEO of Alteo Limited.

Read more

Nov 2019

CIEL GROUPCIEL Limited reports financial results for the first quarter ended 30 september 2019

Group revenue for the quarter ended 30 September 2019 increased by 3% to MUR 6.27bn (2018: MUR 6.09bn) while EBITDA rose to MUR 728M (2018: MUR 616M). Excluding the effect of IFRS 16, EBITDA margin remained stable at 10%.

Read more

Oct 2019

CIEL HOTELS & RESORTSSugar Beach: réouverture du restaurant Citronella's

Après plusieurs mois de travaux, Citronella’s, restaurant emblématique du Sugar Beach a fêté son ouverture le 25 octobre devant un parterre d’invités et de personnalités. Lors de cette soirée, Nicolas de Chalain, le directeur du Sugar Beach, a tenu à remercier «tous les partenaires présents, ITEAT Academy ainsi que toute l’équipe du Sugar Beach dont le Chef Exécutif Mauree et Vedasen Chellayee, Executive Assistant Manager de l’hôtel. » Il souhaite que le Citronella’s puisse devenir une adresse incontournable sur la côte ouest. A cette occasion, le Chef Italien Giuseppe Costa, une étoile Michelin, a fait le déplacement de Sicile. Jeune Chef prometteur, Giuseppe Costa tient un restaurant au petit port de Terrasini près de la mer. Il a remporté le prix du Chef émergent du sud de l'Italie en 2009 avant de recevoir sa première étoile en 2014. Du 20 octobre au 4 novembre, il partagera son savoir-faire aux équipes du Sugar Beach sur la cuisine traditionnelle de Sicile.

Read more

Oct 2019

CIEL TEXTILEAquarelle Clothing Tana remporte le CIEL Textile CMEA Madagascar 2019

C’est dans une ambiance de fête que s’est déroulée le « CIEL Textile Chairman’s Manufacturing Excellence Award Madagascar 2019 » le samedi 12 octobre au Centre de Conférence International, à Ivato à Madagascar. Cet évènement, devenue une tradition chez CIEL Textile, est venu une nouvelle fois récompenser l’excellence au sein des différentes unités de production de vêtements du Groupe. Le titre principal, à savoir le « Chairman’s Manufacturing Excellence Award » qui vient récompenser l’unité ayant démontré les meilleurs niveaux d’excellence toutes catégories confondues, a été attribué à Aquarelle Clothing Tana qui a également raflé le prix du « Best Human Resource Management ». Les « Runner up » dans cette catégorie sont : Floreal Bangladesh, Aquarelle India IPL RCC et Aquarelle Clothing Grand Bois.

Read more

Sep 2019

CIEL FINANCESaleem Ul Haq, COO de la Bank One : "Maurice est l'un des rares marchés à disposer d'un cadre pour les crypto-monnaies et la Blockchain"

Chez Bank One, nous voyons dans le secteur bancaire une plate-forme où tout le monde peut proposer des produits et services et où les banques et la technologie Fintech auront un rôle important à jouer. Aujourd’hui, il n’y a pas de frontières, tous les types de Fintech peuvent s’installer à Maurice. Cela va bouleverser le commerce traditionnel des banques.

Read more

Sep 2019

CIEL GROUPCIEL Ferney Trail 2019 beats its personal best in waste management and boosts inclusion in sports

The 12th edition of the CIEL Ferney Trail attracted a turnout of more than 3,400 people who benefitted from reconnecting with nature. Despite the large crowd of competitors, the event is committed to leaving no trace by eliminating single use products and ensuring effective and educational waste diversion initiatives are part of the program.

Read more

Sep 2019

CIEL FINANCEBNI P@Y, le paiement en ligne par BNI MADAGASCAR

Dans un marché en forte croissance, avec plus de 2 millions d’utilisateurs potentiels d’internet, l’e-commerce présente un avenir des plus prometteurs à Madagascar. Avec BNI P@Y, première plateforme bancaire e-commerce opérationnelle depuis 3 mois, BNI Madagascar a de nouveau démontré sa capacité à innover et répondre à une forte demande des malagasys... Le paiement en ligne !!!

Read more

Sep 2019

CIEL TEXTILEFerney Spinning Mills – Carding & Spinning Department remporte le Chairman’s Manufacturing Excellence Award 2019

Samedi 14 septembre 2019, Pailles - Le « CIEL Textile Chairman’s Manufacturing Excellence Award » qui récompense les unités de production de tissus et de fils de CIEL Textile, s’est tenu le samedi 14 septembre au Swami Vivekananda International Convention Centre, Pailles. Cette 12e édition a été marquée par la présence du Ministre du Travail et des Relations Industrielles, de la Formation et de l’Emploi, l’honorable Soodesh Callichurn, de l’équipe managériale du Groupe CIEL & CIEL Textile, ainsi que de toute la grande famillle de CIEL Textile. Le titre principal, à savoir le « Chairman’s Manufacturing Excellence Award » qui vient récompenser l’unité ayant démontré les meilleurs niveaux d’excellence toutes catégories confondues, a été attribué à Ferney Spinning Mills – Carding & Spinning Department tandis que le prix du « Sustainability Best Practice » est allé à CFL. Le prix du « Most Improved Award » a été raflé par le département Finishing de CDL.

Read more

Aug 2019

CIEL FINANCERencontre avec Sandrine Busviah, Bank One : "Une vie professionnelle réussie, c'est avoir le sourire en rentrant et en sortant du travail, tous les jours"

De sa personnalité émane une énergie positive. Alors qu’elle poursuit son petit bonhomme de chemin à la Bank One, Sandrine Busviah enchaîne les expériences. Rencontre avec cette amoureuse de la nature et du trail, récemment promue ONE Service Team Leader.

Read more

Aug 2019

CIEL FINANCEProjet FIHARIANA : remise des premiers financements par BNI MADAGASCAR

Le programme national d’appui aux entrepreneurs Malagasy FIHARIANA bat maintenant son plein. Initié par SEM le Président Andry Rajoelina, le programme a pour principal objectif de donner à la fois un appui technique et financier aux Malagasy désireux d’investir dans un activité productive. Le démarrage effectif de programme Fihariana au niveau national été réalisé par KRED en octroyant les premières crédits au taux exceptionnel à des paysans-éleveurs de vaches laitières à Andranomanelatra.

Read more

Aug 2019

CIEL FINANCEBank One organises the 1st edition of its Bank One Leadership Discussions series

Bank One organised the first edition of its Bank One Leadership Discussions (BOLD) series on September 10, 2019 at the Hennessy Park Hotel, Ebène in front of an audience regrouping thought leaders from various economic sectors. Pratibha Thaker, Editorial and Regional Director, Middle East and Africa of the Economist Intelligence Unit (EIU), was the keynote speaker debriefing on the global economy and the challenges it is currently facing. While Ben Lim, the Chief Executive Officer (CEO) of Intercontinental Trust Ltd and François Eynaud, CEO of Sun Resorts, shared their insights on the Global Business and Tourism sector respectively.

Read more

Jul 2019

CIEL FINANCEBank One: first in Mauritius to receive LinkedIn training

Bank One is proud to have received on July 15, 2019 the first LinkedIn training in Mauritius with Audrey Mascheroni, Account Director for LinkedIn (Africa) on leveraging the power of LinkedIn as an executive.

Read more

Jul 2019

CIEL HOTELS & RESORTSVictoires du Tourisme 2019 : Sun Resorts élu meilleure chaîne hôtelière

Le groupe Sun Resorts est fier d’annoncer sa victoire en tant que meilleure chaîne hôtelière, parmi une trentaine de nommés, aux Victoires du Tourisme. La soirée s’est déroulée jeudi 13 juin à Paris devant quelques 300 invités.

Read more

Jul 2019

CIEL PROPERTIESVictoire de l’équipe mauricienne de golf pour les JIOI 2019 à Anahita

L’épreuve de golf des Jeux des Iles est un immense succès pour Maurice, aussi bien en équipe et qu’en individuel ! Au total 4 médailles d’or sont remportées par les athlètes nationaux.

Read more

Jul 2019

CIEL AGROAnahita accueillera l’épreuve de golf des JIOI 2019

Du 20 au 23 juillet 2019, la 10ème édition des Jeux des Îles se tiendra à Maurice avec des athlètes venus des quatre coins de l’océan Indien qui se retrouveront pour une semaine de célébration du sport et des valeurs qu’il véhicule. Parmi toutes les disciplines présentes dans ces JIOI et grâce à l’initiative de la Fédération mauricienne, se trouve le golf, qui sera en démonstration comme ce fut le cas en 2015 lors des JIOI à la Réunion.

Read more

Jun 2019

CIEL GROUPShelan's Corner: The do’s and don’ts in designing a CV in 2019

A curriculum vitae (CV) is the Latin word for "the course of your life”. Leonardo da Vinci invented the first professional profile in 1482, which we call as the résumé. Since then, it has been used extensively in the recruitment process. However, does the curriculum vitae as we’ve known it for centuries stand in 2019? Shelan our Talent Acquisition Specialist tells us more about the do’s and don’ts in designing a CV today.

Read more

Jun 2019

CIEL TEXTILELe développement durable : l’opportunité de révolutionner l’industrie du textile

Tribune de Pami Kular, Responsable développement durable de CIEL Textile, publiée dans les colonnes de Business Magazine le mercredi 19 juin 2019. Vous le savez certainement, l’industrie du textile est considérée comme étant l’une des plus polluantes. Fort de ce constat, il est de notre responsabilité d’agir. Mais par où commencer ? Comment faire ? Comment améliorer les choses tout en restant compétitif sans mettre à mal la viabilité et le futur de l’entreprise ? Au niveau de CIEL Textile, nous avons fait le choix d’assumer la réalité, mais aussi de nous engager à repenser nos méthodes en impliquant l’ensemble de nos 20 000 employés répartis sur 5 pays. Car le changement passe avant tout par les idées, actions et comportements des hommes et des femmes au quotidien. Ce n’est qu’en pensant différemment que nous pouvons agir différemment !

Read more

Jun 2019

CIEL FINANCEInvestor’s Circle : 2eme édition réussie pour Bank One Private Banking

Le 23 mai a eu lieu la deuxième Edition de l ’Investor’s Circle organisé par Bank One. Guillaume Passebecq, Head of Private Banking and Wealth Management a rappelé l’origine de cet évènement. Bank One étant en architecture ouverte en terme d’investissement, elle est amené à travailler avec l’ensemble des gérants externes. L’idée d’organiser une réunion ou il serait possible de débattre des sujets liés à la gestion d’actif a rencontré un vif intérêt de la part de ces tiers gérants dès la première Edition de l’Investor’s Circle.

Read more

Jun 2019

CIEL PROPERTIESReinette, our Facility Management company, celebrates World Food Safety Day

The first ever World Food Safety Day was held on the 7th of June 2019. This day was marked by the United Nations and it recognises that food safety has a critical role in assuring that food stays safe at every stage of the food chain, from production to harvest, processing, storage, distribution, all the way to preparation and consumption. At Reinette, the teams gathered to create awareness around these five keys by having talks, and engaged themselves to respect and adhere to them.

Read more

May 2019

CIEL GROUPSustainability Forum: Cross-fertilisation of knowledge and practice for champions

CIEL Sustainability Champions from CIEL's five industry clusters gathered at Ferney Falaise Rouge on May 14th in a participatory workshop-style forum to share their knowledge, experiences and lessons learnt in sustainable practices. The forum provided a platform for cross-fertilisation and learning and an opportunity to leverage initiatives for greater impact across CIEL’s diversified group.

Read more

May 2019

CIEL FINANCEBank One: Elite services for a unique banking experience

Discover Bank One's new tailor-made financial services thanks to Head of Retail Banking, Shehryar Bakht Ali. Elite Banking is this institution's promise of value, convenience and lifestyle benefits for affluent customers looking for a service provider with the ability to respond to their changing needs and expectations... Just a consultation away to turn your life into a masterpiece of joy by achieving your dreams.

Read more

May 2019

CIEL FINANCE"CIEL Cyber Security Committee" : Un bouclier contre le cybercrime

Aujourd’hui, toutes les entreprises, quels que soient leur taille et leur secteur d’activité, doivent faire face à des cyber-attaques provenant d’organisations criminelles de plus en plus puissantes et efficaces. Par ailleurs, l’espace à protéger est de plus en plus étendu avec l’ouverture et l’interconnexion des entreprises, l’utilisation extensive des smartphones, l’exploitation du cloud pour ne citer que ces exemples. Les nombreuses et récentes attaques réussies dans les secteurs d’activités de notre groupe démontrent l’urgence de se protéger et de devenir proactif face aux menaces du cybercrime. Pour contrer ces menaces, le « Cyber Security Committee » (CSC) a été créé début 2018 au sein du Cluster Finance du Groupe CIEL, avec pour objectif d’aider les entreprises affiliées à améliorer leur capacité à piloter les Cyber-Risques et à déployer une stratégie efficace pour diminuer au maximum ces derniers et leurs impacts.

Read more

May 2019

CIEL FINANCEBNI MADAGASCAR accompagne le projet national FIHARIANA

Le Président de la République SEM Andry RAJOELINA a lancé officiellement le programme d'appui national FIHARIANA pour développer l’Entrepreneuriat à l’hôtel CARLTON le samedi 18 mai dernier. De par son partenariat avec les chambres régionales de commerce et d’industrie, sa plateforme intégrée de développement des PME, ses produits et services innovants notamment dans les financements aux entreprises et son expertise financière, BNI MADAGASCAR a tous les ingrédients pour soutenir le programme FIHARIANA en accompagnant les entrepreneurs dirigeants de TPME porteurs de projets créateur de valeur.

Read more

May 2019

CIEL FINANCEBNI MADAGASCAR: Innovating locally with a global perspective

Alexandre Mey, CEO of BNI Madagascar, explains to Global Finance Magazine, the bank's digital strategy and how a commitment to agility, proximity and adaptability has kept BNI in the lead for 100 years.

Read more

May 2019

CIEL HOTELS & RESORTS2019 Golfers' Choice Award: Ile Aux Cerfs élu meilleur golf à Maurice

Sun Resorts est fier d’annoncer que l’île aux Cerfs Golf Club a été désigné meilleur parcours de golf à Maurice par Leadingcourses.com. Ile Aux Cerfs Golf Club raffle ainsi le Golfers’ Choice Award cette année avec une note de 9.1/10.Leadingcourses.com est le plus grand site de « reviews » golf en Europe. Le site répertorie et compare 25 098 terrains de golf dans 150 pays. Chaque mois, plus de 375 000 golfeurs utilisent Leadingcourses pour trouver les meilleurs parcours de golf au monde.

Read more

May 2019

CIEL HOTELS & RESORTSSun Resorts et Sega Tours accueillent les représentants de l'IAGTO

Du 3 au 10 mai, les hôtels Sun Resorts ont accueilli 13 représentants de plusieurs pays pour un FAM Trip ayant pour but de faire découvrir Maurice comme destination golfique. Fondée en 1997, IAGTO compte 2691 membres issus de clubs, hôtels, terrains de golf, opérateurs réceptifs, compagnies aériennes, offices de tourisme, médias et partenaires commerciaux agréés dans 103 pays. IAGTO c’est également 702 organisateurs de circuits de golf spécialisés dans 64 pays. Les opérateurs d’IAGTO contrôlent plus de 87% des forfaits vacances au golf vendus dans le monde.

Read more

May 2019

CIEL HOTELS & RESORTSSun Resorts intègre la Global Hotel Alliance

La Global Hotel Alliance (GHA), la plus grande alliance mondiale de marques hôtelières indépendantes, qui administre le programme de fidélisation multimarque primé DISCOVERY, a annoncé le 7 mai que Sun Resorts sera la dernière marque à intégrer son réseau en pleine expansion de plus de 30 marques indépendantes et 550 hôtels, dans 75 pays.

Read more

Apr 2019

CIEL FINANCEBNI MADAGASCAR s’engage auprès des jeunes entrepreneurs dans le milieu agricole

23 avril 2019, quelques jours après la signature de la convention de partenariat entre BNI MADAGASCAR et le Ministère de l’Agriculture, de l’Elevage et de la Pêche concernant le programme de Promotion de l’Entreprenariat des Jeunes dans l’Agriculture et l’Agro-industrie (ou PEJAA), 35 jeunes Agripreneurs originaires de 13 régions du pays, regroupés dans 27 projets de la promotion pilote FANASINA, ont reçu leur Certificat et leur chèque pour leur installation et le financement de leur projet à l’issue de 12 mois de formation auprès du Centre d’incubation du FIFAMANOR Andranomanelatra dans les chaînes de valeur des filières blé, maïs et lait.

Read more

Apr 2019

CIEL TEXTILEEshan Rassool : « Tous les éléments autour de moi sont sources d’inspiration, il n’y a pas de limite à la créativité, c’est ce qui fait la beauté de mon métier »

Le « Design Leadership » contribue aujourd’hui à la valeur ajoutée de l’offre de Tropic Knits. Eshan Rassool, Head of Design, compte plus 20 ans d’expérience dans le monde de la mode et nous parle de l’évolution de son métier - développement durable, nouvelles technologies et génération Y entre autres.

Read more

Apr 2019

CIEL FINANCEBank One holds its second CX campaign

From April 8 to 12, Bank One teams enjoyed the thrill of the various CX campaign challenges which culminated in a prize giving on April 19. The aim of the campaign is to strengthen the CX culture and align the staff around the customer.

Read more

Apr 2019

CIEL FINANCEProContact s’installe à l’île Rodrigues

ProContact, en installant ses opérations dès 2001, était un des pionniers des centres d’appels à l’Ile Maurice. Après avoir ouvert un site à Madagascar en 2015, ProContact poursuit son déploiement dans l’Océan Indien suite au raccordement de Rodrigues par le câble sous-marin MARS !

Read more

Apr 2019

CIEL FINANCEFareed Soobadar, Divisional Head – Corporate Banking, Bank One : ", les secteurs du tourisme et de l’immobilier sont... les plus porteurs pour notre économie..."

Interview de Fareed Soobadar, Head of Corporate Banking de Bank One - Défi Media - Sneha Peryagh. Le marché local demeure parsemé de défis avec une croissance moyenne dans quelques secteurs clés comme le tourisme, la grande distribution et l’immobilier uniquement. La petite taille de notre économie et par conséquent, de notre population, sont des restrictions inhérentes à la croissance future qui est attendue pour Maurice.

Read more

Apr 2019

CIEL TEXTILETropic Knits Group adopts 6S management techniques

Lean manufacturing is the systematic approach to identify and eliminate all forms of waste and non-value -added activities (NVA) from the business value stream. It is a comprehensive set of tools & techniques. 6S is a basic tool and the first step in Lean Manufacturing, which is a Japanese concept for organising a standard workplace and work to reduce waste (in terms of searching time, materials, non value-added activities) to provide a safe working environment and to achieve Operational Excellence.

Read more

Apr 2019

CIEL GROUPSHELAN'S CORNER : 1O interview tips to secure your dream job!

If you have interviews coming up, these tips are for you. From pre-interview preparation to post-interview follow up, Shelan’s tips will help you be the best of yourself. Remember, your enthusiasm and attitude will reflect a lot of your personality. Herewith below is how you can secure your dream job.

Read more

Apr 2019

CIEL TEXTILELe textile : une industrie du futur!

Nous sommes depuis plus d’une décennie au tournant d’une industrie qui se transforme, une industrie qui doit répondre à l’évolution d’un marché chaque jour plus complexe et plus exigeant. Nous sommes au cœur de l’industrie 4.0 qui remet en question les moyens traditionnels de production. Comment y parvenir ? Il nous faut repenser tous les modèles classiques et bâtir une société agile qui puisse s’adapter aux changements constants des tendances et des marchés.

Read more

Mar 2019

CIEL FINANCEBNI MADAGASCAR awarded Best Bank of Madagascar by Global Finance Magazine

Global Finance magazine has announced its 26th annual awards for the World’s Best Banks. The winners of this year’s awards are those banks that attended carefully to their customers’ needs in difficult markets and accomplished better results while laying the foundations for future success. All selections were made by the editors of Global Finance after extensive consultations with corporate financial executives, bankers and banking consultants, and analysts throughout the world.

Read more

Mar 2019

CIEL GROUPBourse : CIEL Limited fait son entrée sur le SEMSI

L’approche de CIEL en matière de développement durable récompensée par le Comité de Surveillance de la bourse de Maurice. Le Groupe a affiché un score moyen de 80.34% dans les 4 catégories visées par le SEMSI - la Bonne Gouvernance, l’Economie, l’Environnement et le Social - indiquant une bonne performance générale. CIEL Limited, la holding du Groupe et membre du SEM 10, sera donc officiellement listée sur le Stock Exchange of Mauritius Sustainability Index (SEMSI) à partir du vendredi 29 mars.

Read more

Mar 2019

CIEL FINANCEUne première à Maurice : Bank One introduit le CashBack et le ‘Free for Life’ sur ses cartes de crédit

Bank One étoffe considérablement son offre relative aux cartes de crédit avec les récompenses CashBack et le ‘Free for Life’, applicables sur toutes ses catégories de cartes individuelles– Classic, Gold, Platinum et Infinite ; une première à Maurice. La particularité du CashBack est que le client n’a aucune intervention à faire, ajoute Shehryar Ali, Head of Retail Banking à la Bank One.

Read more

Mar 2019

CIEL GROUPCIEL Group celebrates the 51st Anniversary of the Independence of Mauritius

On the occasion of the 51st Anniversary of the Independence of Mauritius, CIEL Group has carried out various activities across its clusters. This calendar of activities translates CIEL’s commitment to its values: People at Heart, Excellence at Core and Ethical and Sustainable.

Read more

Mar 2019

CIEL GROUPLe message de Jean-Pierre Dalais, Group Chief Executive, à l'occasion des célébrations du 51eme anniversaire de l'Indépendance de Maurice

51 ans depuis que notre île Maurice a accédé à son Indépendance. Quel chemin parcouru ! Une histoire portée par l’ambition et la vision d’un peuple résilient, ouvert aux autres et tourné vers l’avenir. Bravo à vous citoyens, qui chaque jour, contribuez à l’avancement de notre île par votre passion, votre engagement et votre désir de Go Beyond. Alors que nous marquons, aujourd’hui, une journée fortement symbolique pour tout un peuple, j’ai voulu, humblement, vous partager mes observations.

Read more

Mar 2019

CIEL AGROAlteo et Quadran inaugurent leur ferme solaire Helios Beau Champ

Issue du partenariat entre le groupe mauricien Alteo et le groupe français Quadran, la ferme photovoltaïque Helios Beau Champ a été inaugurée le 7 mars 2019.

Read more

Mar 2019

CIEL GROUP#IWD2019 : 5 women at CIEL share their navigating paths to gender equality

A balanced world is a better world! As we celebrate the International Women’s Day, it is important for all of us to reflect on and celebrate women’s achievements. We strive as an employer to provide the environment that allows both men and women to grow as we see talent before gender. We are proud to share with you some of the many success stories driven by women at CIEL.

Read more

Mar 2019

CIEL TEXTILEAnnabelle Lonborg-Nielsen, directrice de la 361° Leadership & Management Academy : "Le 'talent management' n'est pas juste un mot à la mode"

Le 'talent management' s'intègre dans une stratégie globale pour atteindre des objectifs concrets de l'entreprise. Interview d'Annabelle Lonborg-Nielsen, directrice de la 361° Leadership and Management Academy - Le Défi Quotidien, 4 mars 2019, par Sneha Peryagh

Read more

Feb 2019

CIEL FINANCEBank One celebrates its 10th anniversary with its clients

Bank One marked its 10 years of existence by gathering its key customers, directors, leadership team and business partners at Sugar Beach Resort in Flic-en-Flac on 5th December 2018 for an evening of celebration and sharing.

Read more

Feb 2019

CIEL FINANCE1919-2019 : BNI Madagascar célèbre ses 100 ans !

1919-2019, BNI MADAGASCAR, la vénérable institution centenaire, a toujours été en osmose avec l’histoire économique du pays. Le Samedi 26 janvier dernier, BNI MADAGASCAR a réservé à ses collaborateurs la primeur de la célébration de ce jubilé au Centre de Conférences Internationales d’Ivato.

Read more

Feb 2019

CIEL HEALTHCAREOne of the largest ovarian cysts (40cm) in the world removed at Wellkin Hospital

One of the largest ovarian cysts was diagnosed and operated laparoscopically at Wellkin Hospital recently. The 15-year-old patient came with a complaint of distended abdomen (belly that was abnormally big, almost like 36 weeks pregnant woman!). CT scan performed detected abnormally large ovarian cyst measuring 40cm x 23cm x 18cm which was pressing against the patient’s chest and other organs. This GIANT ovarian cyst was removed through a laparoscopic surgery (i.e. only small incision) by Dr. Farhad Aumeer (Obstetrician, Gynaecologist and Laparoscopic Surgeon, Wellkin Hospital).

Read more

Feb 2019

CIEL TEXTILEAyaz Tajoo, Co-General Manager, Aquarelle Maurice & Madagascar : "Il ne faudrait pas tourner le dos à l'industrie du textile..."

Interview dans le journal Le Dimanche/L'Hebdo - 10-16 février 2019 - Kamlesh Bhuckory Le textile a connu une importante transformation et le talent des travailleurs étrangers aussi bien que celui des Mauriciens est essentiel pour faire tourner cette industrie. Le textile recommence à attirer les mauriciens et offre des possibilités de carrière aussi bien dans le design, le marketing, la formation, la gestion que dans le développement durable...

Read more

Jan 2019

CIEL GROUPCIEL s'équipe d'une plateforme "Talents & Culture"

Gestion des Ressources Humaines : Le développement des talents est une des priorités du Groupe CIEL. D'où la mise en place du concept "Talent & Culture". Questions à Jean-Pierre Dalais, Group Chief Executive Officer de CIEL par Lindsay Prosper pour le journal l'Express.

Read more

Jan 2019

CIEL HOTELS & RESORTSLong Beach Hotel awarded "Food Waste Champion" title by Travelife

Long Beach Hotel, 5-star hotel from Sun Resorts has been awarded the "Food Waste Champion" title by Travelife, a certification program that gives hotels, travel businesses and resorts acknowledgement for their sustainable efforts (social, economic and environmental) in the tourism industry.

Read more

Jan 2019

CIEL HEALTHCARENew record: 107 babies born in December 2018 at Wellkin Hospital

Wellkin is well equipped to handle and manage all high-risk pregnancies. Our obstetrics unit is equipped with a neonatal intensive unit to care for sick newborns, including pre-term babies. The hospital has once again achieved the highest deliveries ever in a single month. 107 babies were born in the month December 2018. This is the highest ever in a private clinic.

Read more

Dec 2018

CIEL TEXTILETropic Knits part of founding signatories of the UN Fashion Industry Charter for Climate Action

UN Climate Change News, Katowice, 10 December 2018 – The global fashion sector today significantly increased momentum to address climate change by launching the Fashion Industry Charter for Climate Action. Under the auspices of UN Climate Change, leading fashion brands, retailers, supplier organizations, and others, including a major shipping company, have agreed to collectively address the climate impact of the fashion sector across its entire value chain.

Read more

Dec 2018

CIEL TEXTILEFerney Spinning Mills: Sustainable Future

Mauritius-based wool yarn producer Ferney Spinning Mills is aiming to capitalise on the growing demand for wool products through a range of new initiatives. Twist spoke to the company’s general manager Mushtaq Sooltangos to find out about the company’s plans.

Read more

Dec 2018

CIEL TEXTILETropic Knits Group participated in the discussion around United Nation Fashion Industry Charter for the Climate Action

Zaynab Khodabocus, Sustainability Manager, participated in the discussion around the Charter in Bonn, Germany, earlier in September together with leaders of the fashion industry who mobilised to fight #ClimateChange.

Read more

Nov 2018

CIEL GROUP« Acheter solidaire » et faire ainsi honneur à l’esprit de Noël !

L’édition 2018 du Marché de Noël poursuit sur sa lancée 2017 avec le concept de « marché itinérant, » c’est-à-dire qu’il se tient dans deux lieux différents pour atteindre un plus large et différent public. Organisé depuis 2011 par la Fondation CIEL Nouveau Regard (FCNR) et ACTogether.mu (plateforme gérée et financée par la FCNR), le Marché de Noël Solidaire met à l’honneur le travail d’artisans issus du milieu associatif. Ces derniers travaillent de toute manière déjà tout au long de l’année, au cœur d’ateliers créatifs bien structurés, sur des programmes à visée thérapeutique et/ou visant à les renforcer en capacités. L’intégralité des recettes revient aux ONG participantes : OpenMind, Friends in Hope, Autisme Maurice, Centre de Formation Canne en Fleur, Etoile d'Espérance, Le Pont du Tamarinier, Atelier de Formation - Joie de Vivre, Baz'Art Kreasion, Localhands et Fondation pour l'Enfance - Terre de Paix.

Read more

Nov 2018

CIEL FINANCEInauguration de la première 'agence verte' de BNI MADAGASCAR

Opérationnelle depuis déjà quelques semaines dans le quartier d’Antanimasajy, Mahajanga, la première AGENCE VERTE de BNI MADAGASCAR a été inaugurée officiellement le 29 novembre. Cette cérémonie a marqué une étape importante dans la politique de proximité de BNI MADAGASCAR avec l'ouverture de cette troisième agence dans la Cité des Fleurs. Mais l’événement est surtout historique car l’agence d’Antanimasajy, alimentée entièrement à l'énergie solaire, est une illustration de la démarche écoresponsable de BNI MADAGASCAR.

Read more

Nov 2018

CIEL TEXTILECIEL Textile empowering communities through 'ACT for our Community' programme

While CIEL Textile has been involved in various CSR-related actions for many years, the Act For Our Community initiative, launched in 2016, brings employees’ involvement to a whole new level. Performing small actions with great love has become part of their value system as they drive several events throughout the year, building solidarity amongst their employees. Some 10,000 employees across five countries, Mauritius, Madagascar, South Africa, India and Bangladesh, have raised more than MUR 7 million to support NGOs in their respective surrounding communities last year.

Read more

Nov 2018

CIEL PROPERTIESAndré Bonieux appointed CEO Designate at Alteo as from November 1st 2018

André Bonieux officially joined Alteo as CEO Designate on Thursday November 1st 2018. He will work alongside the current CEO, Patrick d’Arifat, until the latter’s retirement at the end of the year. André will officially be named CEO of Alteo on January 1st, 2019.

Read more

Nov 2018

CIEL GROUP#BouzeMoris Band invite à "kree enn Moris meyer"

C’est au travers une chanson que 11 collaborateurs du Groupe CIEL ont décidé de faire bouger les lignes. L’aventure commence en mai de cette année, avec le lancement de la plateforme www.bouzemoris.mu par le Groupe CIEL. Les citoyens sont invités à partager leurs idées et initiatives pour faire Maurice avancer, ce qui a inspiré quelques collègues du Groupe à venir de l’avant avec le projet de créer une chanson pour faire littéralement bouze toute l’île.

Read more

Oct 2018

CIEL HEALTHCARE« Octobre Rose » pour Wellkin Hospital et Fortis Clinique Darné

Wellkin Hopsital et Fortis Clinique Darné ont organisé durant le mois d’octobre des activités consacrées à la sensibilisation et à la promotion du dépistage du cancer du sein. Le dépistage précoce est l’un des moyens les plus efficaces dans la lutte contre le cancer du sein.

Read more

Oct 2018

CIEL FINANCECIEL Ferney Trail 2018 : 5 questions à Sandrine Busviah, 2e au classement Senior & 1ère au classement général (F) des employés du Groupe CIEL

CIEL Ferney Trail 2018 : 3700 participants, 200 volontaires et quelques 1000 collaborateurs du Groupe CIEL à faire partie de cette aventure humaine. Parmi, Sandrine Busviah, Senior Client Service Coordinator à la Bank One. Elle est 5ème au classement général féminin, 2ème au classement senior et 1ère au classement général (F) des employés du Groupe CIEL. Rencontre.

Read more

Oct 2018

CIEL FINANCEBank One and IPRO collaborate to create the Sales Challenge

Over the month of June, Bank One’s Private Banking team and IPRO collaborated to create the Sales Challenge – an initiative aimed at encouraging and rewarding the promotion of IPRO’s management services, and more specifically, of its Growth Fund.

Read more

Oct 2018